About MBS

- MBS (Mortgage-Backed Security) is a type of beneficiary securities issued with the mortgage loans* as underlying assets.

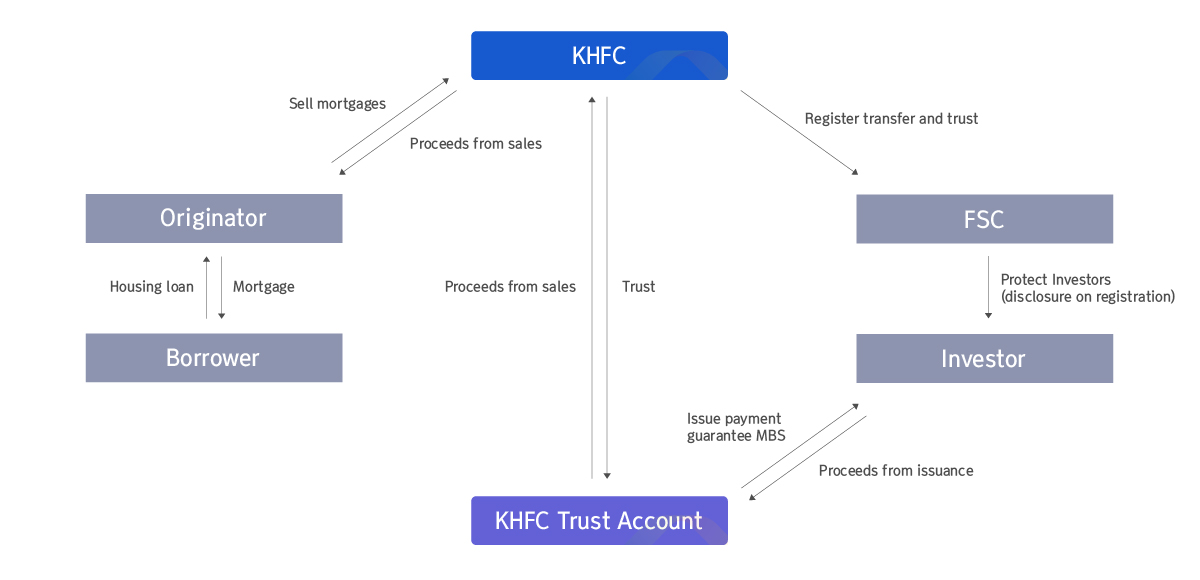

- Financial institutions, such as banks, originate mortgage loans for home buyers and transfer the loans to KHFC for securitization.

- Financial institutions, such as banks, transfer the mortgage loans to KHFC.

- KHFC, after establishing a trust with itself as a trustee of the loans, issues beneficiary securities (MBS) with the loans as underlying assets.

* Mortgage loans are a bond that bestows the lenders(financial institutions) with the right to collect debt payment from the borrowers in the future with houses as collateral.

MBS Issuance Structure

- By issuing MBS, KHFC acts as an intermediary between investors in the capital market and borrowers in the housing finance market.

- This can benefit housing finance borrowers, financial institutions and investors.

- You can find the details of the benefits each participant receives on the ‘Benefits of MBS’ drop-down list.

- Mortgage loans are a bond that bestows the lenders(financial institutions) with the right to collect debt payment from the borrowers in the future with houses as collateral.