KHFC’s Commitment to Sustainability

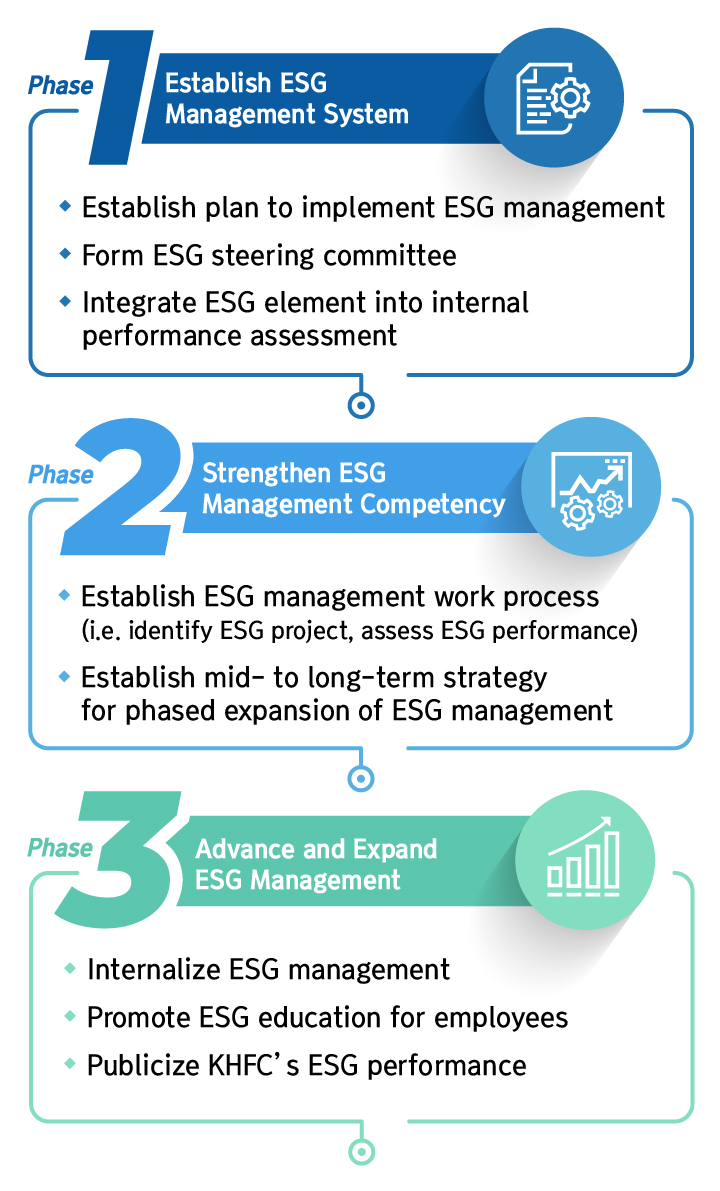

- In 2021, KHFC established an ESG management strategy and roadmap with a mission to supply sustainable housing finance based on green and socially responsible management and transparent governance. To strengthen ESG practices. KHFC created an ESG dedicated task force system including Volunteer Corps · Department/Branch ESG team and formed the ESG Committee.

ESG management strategy

- (E) EXPAND ECO-FRIENDLY INFRASTRUCTURE

(S) ADVANCE SOCIALLY RESPONSIBLE MANAGEMENT

(G) ESTABLISH TRANSPARENT GOVERNANCE

- Moving in line with such strategy and roadmap, KHFC plan to continuously expand our ESG business, as well as funding activities.

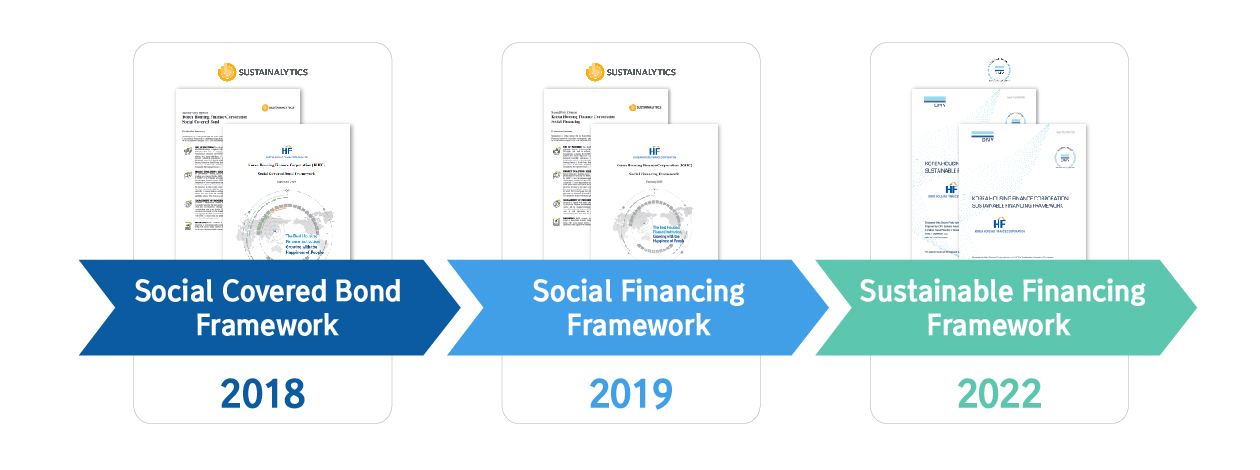

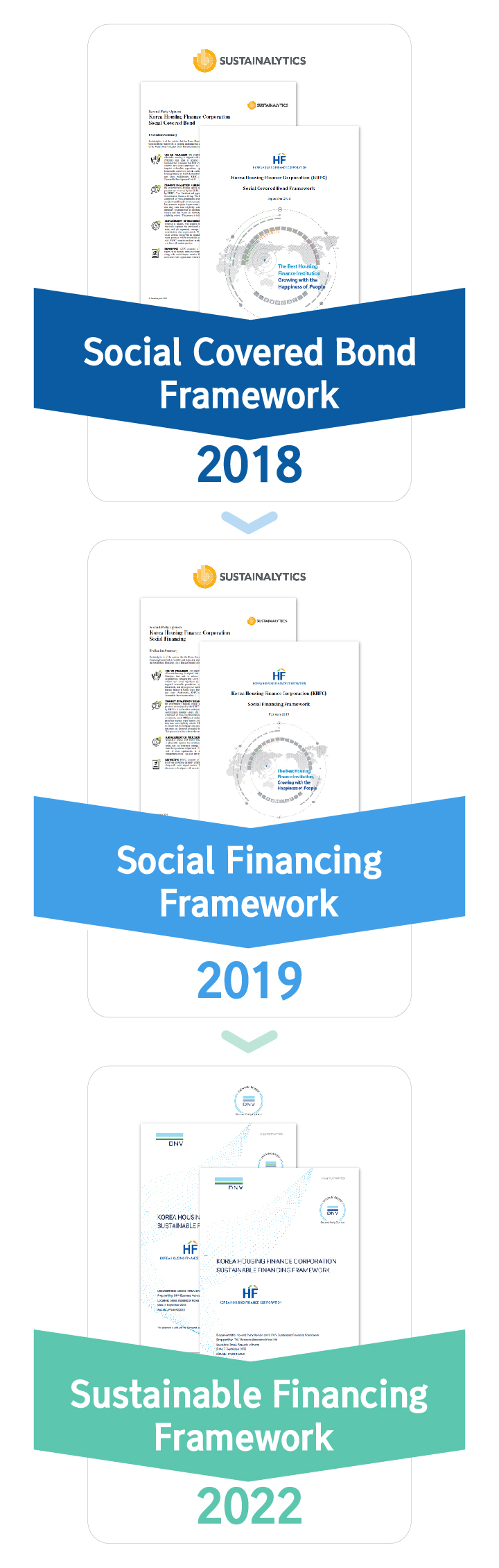

Building the Sustainable Finance Framework

- In response to the growing international interest in socially responsible investments, KHFC established the covered bond framework in September 2018, and issued the first Euro Social Covered Bond in Asia.

- KHFC has also established a social financing framework in order to lay the foundation for socially responsible investment in the domestic bond market, and has been issuing all MBS and covered bonds in the form of social bonds since March 2019. In September, 2022, KHFC updated the social financing framework, and converted it to a Sustainable Finance Framework by adding the use of the issuance funds in green projects.

- KHFC’s sustainable finance framework has been recognized by DNV, an international certification body that its public mortgage supply and securitization business are contributing to realizing the social value of promoting housing welfare for low-to-moderate income households and improving the stability of the housing finance market. In addition, the agency recognized that the supply of public mortgages and securitization business of KHFC related with accredited green buildings would bring about clear environmental benefits.

- KHFC plans to fully comply with the four core elements defined by ICMA in issuing green, social and Sustainability bonds, and to use the proceeds to fund the green projects and the projects related with the social values such as housing welfare.

The Four Core Elements

- Use of Proceeds

- Process for Project Evaluation and Selection

- Management of Proceeds

- Reporting

Effect of Issuance of ESG Bonds Issuance

- Enhancing the issuance stability with the expansion of the investor-base, making the supply base of public mortgages more stable.

- Increasing awareness of KHFC as the organization at the fore front of promoting green and social values, thereby maximizing the marketing effects at home and abroad.

- Playing the leading role of activation of ESG bonds, and contributing to establishing the foundation for socially responsible investments in the domestic market.