What is a housing guarantee for individuals?

- A type of guarantee offered for individuals seeking to take out loans from financial institutions to rent or purchase a house or pay mortgage installments for newly built apartments

Product type

- Guarantee for Jeonse Loans

For a monthly rental loan from a bank - Guarantee for Mortgage Installments

For a loan to pay a mortgage installments for presale-in-lots apartments - Guarantee for House purchase

Available where the house is deemed insufficient collateral - Guarantee for Construction/Renovation Loans

Available where the existing collateral is insufficient for the loan for constructing or renovating a house - Guarantee for Rental Deposit Refund

Available for a loan originated from a bank to refund a rental deposit to the lessee - Guarantee for Monthly Rental Loans

Guarantee Limits for Individuals for a Loan Purpose

- Construction/Renovation: KRW100 M

- House Purchase: KRW100 M

- Rental Deposit Refund: KRW700 M in Seoul, Gyeonggi and Incheon. KRW 500 M in other areas.

- Jeonse Deposit: KRW400 M

- Regular Mortgage Loan Installments: KRW300 M

- Loan-linked Installments: KRW500 M

- Monthly Rental: KRW 100 M

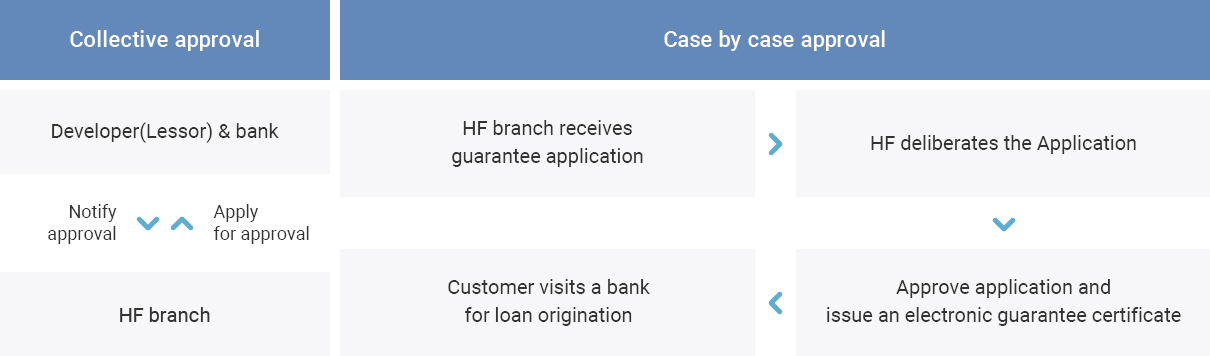

Procedures for securing guarantees for individuals

1

Eligibility Check

Log on to the HF website to check the Guarantee Limit

Log on to the HF website to check the Guarantee Limit

- Enter personal information

- Check eligibility

- Check available the limit

2

Application Submission

Visit a bank and submit application documents

Visit a bank and submit application documents

- Check required guarantee application documents

- Fill out an application form.

- Submit documents to a lender(bank).

3

Application Deliberation

- Guarantee application is rejected where;

- A fraud is suspected.

- The credit rating for the applicant is lower than the acceptable criteria.

- House Purchase contract is verified.

4

Result Notification

CSS (Credit Scoring System)

CSS (Credit Scoring System)

- Guarantee approval result is notified with the below information;

- Guarantee Number.

- Guarantee Limit.

- Guarantee Fee Rate.

Guarantee for rental home purchase and rental installments

Guarantee for rental home purchase and rental installments

This image is optimized and serviced in the PC version.

If you want to check the image, click the ' View in a new window ' button You can check it after clicking it.

View in new windowIf you want to check the image, click the ' View in a new window ' button You can check it after clicking it.

Grounds for Guarantee Rejection

- Guarantee is denied when applicants

- Are involved in a guarantee incident as indicated in the KHFC Credit Management Regulations and handled accordingly (including reservations for the handling of such an incident wherein; the same handling shall apply hereinafter)

- Have a insufficient credit rating as specified in the Guarantee Rejection under the KHFC Credit Scoring System

- Have any derogatory items on their credit records

- Are principal debtors and co-signers of guarantees of indemnified debts

- Have submitted inappropriate data and/or are still in the guarantee restriction period

- Are overdue on loans originated from financial institutions, and

- Are subject to guarantee restrictions as determined by the KHFC president

Guarantee fees

- HF charges guarantee fees for providing guarantees for Jeonse Loans, home purchases, and installment payments.

- The guarantee fees may be paid on an annual basis. In the case of lump sum payments, a discount is applied to the guarantee fee for payments of more than one year.

- According to the business arrangement between KHFC and banks, matters regarding the collection and refund of guarantee fees are handled by the banks on behalf of KHFC.